The Eurozone Could Be the Catalyst for the Next Stock Market Crash

Troubles are brewing in the eurozone once again. It has to be asked whether the common currency could be the reason we end up seeing a stock market crash.

You see, a stock market crash happens mainly due to perception change. If investors all of a sudden start to think that things are going to get bad, they will end up running for the exit and selling. This causes losses.

As it stands, the third-biggest economic powerhouse of the eurozone, Italy, is going through a political crisis.

Italy had elections not too long ago, and two anti-establishment parties (the Five Star Movement and the League) were trying to form a government. Before they could even get into power, they failed to come to an agreement.

This was mainly because these two parties were trying to choose Paolo Savona, a critic of the euro, as finance minister. This idea was not taken very well in the Italian parliament. (Source: “Italy at risk of new financial crisis in wake of coalition’s collapse,” The Guardian, May 29, 2018.)

Now it’s very uncertain what’s next. There could be another election in Italy as soon as July.

On this news, Italian bond yields have been soaring. The yield on two-year Italian bonds hit 2.83%—the highest level since 2013. These yields had the biggest one-day jump in 26 years!

Why Does Italy Matter?

Over the past few years, investors have bought the idea that the eurozone is fine, when it isn’t. This is mainly because the European Central Bank (ECB) stepped in and said it will do whatever it takes.

The news of political uncertainty in Italy could make investors rethink a lot of those things. They could be questioning the euro and the eurozone. Mind you, Italian banks still have a lot of bad debt on their balance sheets.

Why Could Italy Be the Catalyst for a Stock Market Crash?

Dear reader, remember what I said earlier: a perception change could cause a stock market crash.

Suddenly, the eurozone, a major economic hub in the global economy, is facing headwinds.

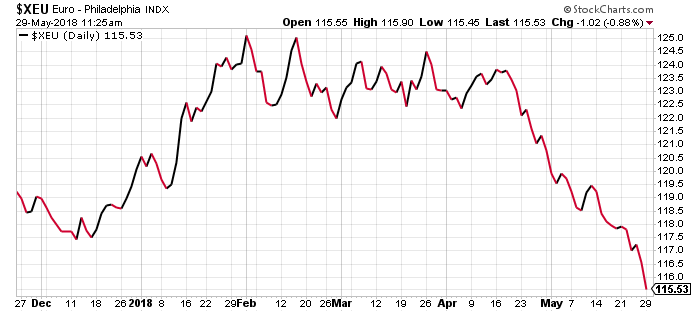

This is already hurting the value of the euro. Look at the chart below of the Euro Currency Index, which tracks the performance of the euro relative to other currencies.

Chart courtesy of StockCharts.com

Since its peak in January of this year, the euro has declined by close to eight percent. It could drop more.

Now, know this: the U.S. isn’t an island nation. A lot of American companies and banks have operations in Europe. What do you think will happen to their stock prices if the troubles in Italy—and ultimately, the eurozone—get bigger?

If you recall, in the midst of the European debt crisis around 2011, the U.S. stock markets were facing rigorous selling. If the financial problems get bigger in Italy, don’t be shocked to see a stock-market-crash scenario again.

I can’t stress this enough: Don’t ignore what’s happening in Italy and the eurozone. I know, at times, investors disregard issues happening in the global economy. They think they won’t be affected by those issues.

But investors beware. It wouldn’t be a bad idea to focus on capital preservation, be it by cutting losses, taking some profits off, or just setting stops on existing positions. That way, in case there’s a stock market crash, investors won’t end up losing a lot.